How APIs determine winners and losers

In today's edition, I'm focusing solely on API businesses like Stripe, Shopify, Postman, which I consider true API powerhouses, employing different strategies, tactics for building & scaling platform.

At the outset, I'd like to welcome new subscribers. And thank you all for your trust and for being here. I write for myself, BUT knowing how many people have been reading this is my greatest reward. Thank you for being here!

This is a weekly newsletter featuring thoughtful analyses at the intersection of business and technology. I uncover underlying mechanisms and describe what truly drives our modern world, looking beyond surface-level trends. To receive Monkey by the Chess in your inbox, subscribe here for free

I wanted to start with a brief introduction to what an API is and how it works, and I couldn't find a better video than this.

This is something I've been thinking about a lot: APIs, products, strategy, and controlling data and access. It brings me here, and I want to explore it further. While everyone debates AI strategies and digital transformation, the real war is unfolding at the API level, reshaping entire industries.

Companies controlling critical APIs now wield unprecedented power to determine which businesses thrive and which struggle, creating a new axis of competitive advantage that transcends traditional market dynamics.

"He who controls the spice controls the universe.”

The stakes are enormous: Stripe achieved a $95 billion valuation primarily through an API strategy. Shopify's partner ecosystem generates $12.5 billion annually (40% more than its core platform revenue), and recent API restrictions by platforms like Slack and LinkedIn have triggered hundreds of millions of dollars in potential new fees, while reshaping entire developer ecosystems.

It’s not only about the technology, but rather who controls the foundational infrastructure. It’s a fundamental evolution from product-centric to platform-centric competition, where success depends less on individual features and more on ecosystem orchestration.

As venture capital firm Andreessen Horowitz notes, modern platform battles are "fought at the API level," with control over data access and developer relationships determining market leadership.

APIs, like times, they're changing

API, they aren't just pipes anymore, they're becoming a strategic advantage. Application Programming Interfaces have evolved far beyond their original role as technical connectors. Today's APIs serve as digital business contracts, enabling companies to rapidly scale, innovate, and capture value across entire ecosystems.

According to Gartner's 2024 research, 82% of organizations use APIs internally, and 71% consume third-party APIs, with demand expected to grow by more than 30% through 2026, primarily driven by the integration of AI.

The technical foundation

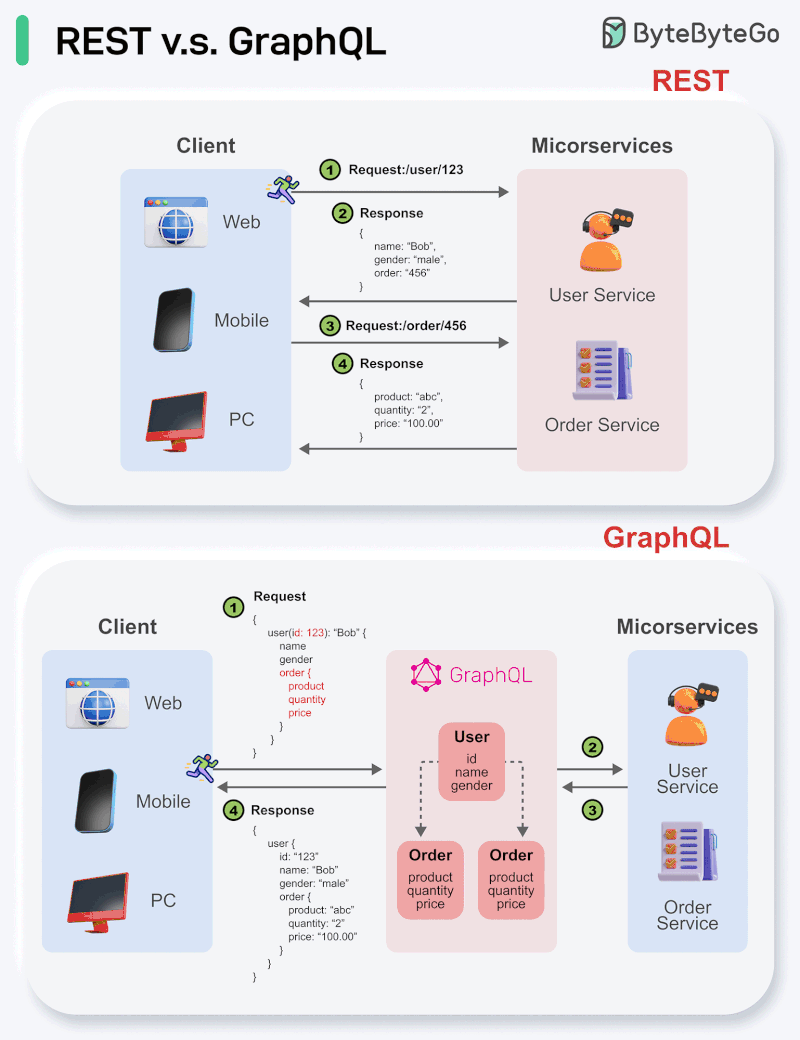

The technical foundation matters because architectural choices have a direct impact on business outcomes. REST APIs, used by 85% of public APIs, offer universal compatibility and low learning curves, making them ideal for public-facing integrations and traditional web applications.

GraphQL, adopted by companies such as Facebook and Shopify, reduces mobile bandwidth costs and accelerates development by fetching only the necessary data in a single call.

gRPC, favored for internal systems, delivers 200% better performance than REST, which is critical for high-frequency trading or real-time applications where milliseconds translate to millions of dollars in revenue.

The best choice between REST, GraphQL, and gRPC depends on the specific requirements of the application and Team preferences. GraphQL may work well with complex and frequently changing frontends, while REST is better suited for apps where consistent and straightforward contracts are preferred.

API-first organizations report game-changing advantages, including an 80% reduction in development time from idea to deployment, with 63% of teams now producing APIs in under a week (up from 47% in 2023).

This speed advantage compounds over time, enabling rapid response to market opportunities while competitors struggle with legacy integration challenges.

The monetization blueprint

API monetization has evolved into sophisticated business models that generate billions in revenue.

Twilio demonstrates the power of usage-based pricing, generating $4.46 billion annually by processing nearly 1 trillion digital interactions. With a simple model of $0.0075 per SMS and per-minute voice pricing scales elegantly with customer success, while maintaining high gross margins typical of API businesses.

Stripe's transaction-based approach (2.9% + $0.30 per transaction) has generated over $18.4 billion in processing volume during peak periods, with the company achieving a remarkable 45% compound annual growth rate from 2018 to 2023.

Subscription models create predictable revenue streams.

We observe a superior velocity through developer-focused API design.

Postman achieved a $5.6 billion valuation, with revenue multiples exceeding 100 times exceptional, even for SaaS companies, due to strong network effects and switching costs.

I recently completed a speedy onboarding to Postman, and I’m impressed by how the tool is performing. The company serves millions of developers globally through tiered pricing that scales from freemium to enterprise.

Building a platform-scale API ecosystem requires teams of 3-8 specialists, including software developers (backend and DevOps) + a solid product manager who stays close to the client, and iteratively gathers requirements and feedback + significant infrastructure investment in gateways, monitoring, and security systems.

API is a data-driven business model; everything can be counted, and KPI's separate winners from losers. Successful API platforms track key metrics, including Monthly Active Users, Revenue per Developer, Customer Lifetime Value, and time to first API call.

How platforms weaponize access controls

In the years 2024-2025, many companies realized the value of their data for AI training and competitive positioning. Who has the data has the advantage.

JPMorgan's threat to charge fintech aggregators up to $300 million annually exemplifies this strategic shift from open access to monetized control.

In May 2025, Slack restricted Non-Marketplace apps, resulting in an 87% reduction in API call allowance. The allowance was reduced from 1,000 messages at 50+ requests per minute to 15 messages per request at 1 request per minute. It might be considered an unfair competitive advantage or full control of the owned platform.

The restrictions particularly devastate enterprise copilots, knowledge management systems, and business intelligence platforms that depend on historical context for value delivery.

LinkedIn's restrictive Partner Program approves fewer than 10% of applications, with approval timelines ranging from 3 to 6 months, creating significant barriers to third-party innovation. Alternative services now cost 40-483% more than original APIs, forcing developers toward unofficial scraping methods or abandoning LinkedIn integration entirely.

These restrictions share common motivations: protecting AI training data, optimizing revenue streams, creating competitive moats, and recovering infrastructure costs. It reveals a strategic dysonans where platforms must balance ecosystem growth against direct monetization.

Stripe and Shopify prove the platform advantage

How does Stripe reduce the friction? The company's developer-centric approach requires only 7 lines of code for checkout integration, dramatically reducing friction compared to traditional payment processors.

Stripe's $95 billion valuation story illustrates API-first competitive advantages. This technical superiority enabled rapid ecosystem expansion, processing $1.4 trillion in payment volume in 2024 (a 38% year-over-year growth) across 3 million businesses, including 50% of Fortune 500 companies.

How does Stripe bind clients? Stripe’s ecosystem strategy extends beyond payments; their BaaS (Banking as a Service, with Treasury, Issuing) enables customers like Shopify to offer financial services, creating deeper integration and higher switching costs. AI-powered infrastructure, such as Stripe Radar, saved businesses over $10 billion in fraud losses during 2023, providing measurable customer value that justifies premium pricing.

How does Shopify work with Partners? Shopify's partner ecosystem generates $12.5 billion annually, which is 40% more than $8.88 billion platform revenue, demonstrating how successful platforms create value multipliers. With over 100,000 partners across 50 countries, Shopify has established an ecosystem that supports 3.6 million jobs globally and generates $319 billion in economic activity.

Partner success stories validate the model: email marketing app Klaviyo raised $200 million and achieved a $4 billion valuation by 2021, primarily through growth within the Shopify ecosystem. With over 9,700 apps in their store and 87% of merchants using an average of six apps each, Shopify demonstrates how platforms enable specialized solutions while reducing their own development burden.

I see it as an excellent framework while building the platform. First, focus on the core product. Then, apply hybrid business models, drive platform conversion among existing customers, and leverage network effects to increase the switching costs.

How network effects work for APIs

API ecosystems generate multiple network effect types that compound competitive advantages.

Direct network effects occur when more developers using an API increase the value for all users, as evident in payment APIs, where merchant adoption attracts more developers, creating self-reinforcing growth cycles.

Indirect network effects emerge in two-sided markets that connect complementary groups, where the platform's value increases as both sides grow simultaneously.

Stripe exemplifies data network effects: processing global payment data enables superior fraud detection through Stripe Radar, which saved customers over $10 billion in 2023. This accumulated intelligence creates competitive moats that new entrants cannot easily replicate, as data quality improves with scale.

Shopify's ecosystem demonstrates network orchestration: as more merchants join, they attract more app developers, which in turn create more specialized solutions, attracting even more merchants. This virtuous cycle generated $12.5 billion in partner revenue while creating 3.6 million jobs globally, far exceeding what Shopify could achieve through direct product development alone.

Economic analysis reveals valuation premiums for companies with strong network effects. API-focused platforms, such as Postman, command revenue multiples of 100x or more compared to typical SaaS multiples of 4.8-5.2x, reflecting investors' recognition of their exponential scaling potential and defensive characteristics.

Developer experience catalyzes network effect activation. Companies that achieve superior developer onboarding, as measured by "time to first API call," see dramatically higher adoption rates. As outlined above, Stripe's 7-line integration, compared to competitors' complex implementations, directly correlates with their market share gains and ecosystem growth velocity.

How AI & Blockchain drive the growth

The API economy is undergoing an AI-driven transformation, with the global AI API market projected to expand from $44.41 billion in 2025 to $179.14 billion by 2030, representing a 32.2% compound annual growth rate. This growth stems from AI's fundamental dependence on external data accessed through APIs, creating new competitive dynamics around data access and algorithmic capabilities.

By 2025, 70% of new applications are expected to utilize AI-powered APIs, according to Gartner's predictions, resulting in a 70% reduction in development time for AI-enabled features. This acceleration stems from composable AI architectures where organizations combine multiple AI services through API integration rather than building everything internally.

Investment patterns reveal strategic priorities. I was writing about it in my previous editions. AI deals represent 60% of all venture capital fundraising in Q4 2024, with generative AI funding nearly doubling from $24 billion in 2023 to $45 billion in 2024. Late-stage deal sizes averaged $327 million, compared to $48 million in 2023, indicating investor confidence in AI-API integration opportunities.

Blockchain integration enables new monetization models through tokenized API access, with 30% of public APIs expected to incorporate blockchain-based verification by 2025.

How developer experience determines API success

Developer-focused companies consistently outperform their competitors through superior ecosystem growth and partner adoption. Comprehensive documentation has a direct correlation with API adoption rates. Well-documented APIs experience 3 times higher usage than poorly documented alternatives.

Technical choices impact developer satisfaction. REST's universal compatibility enables broad adoption. GraphQL's flexible data fetching improves the mobile developer experience. gRPC's superior performance attracts high-scale enterprise developers.

Community support and tooling create switching costs: active developer forums, comprehensive SDKs, and AI-enhanced documentation become competitive differentiators.

Conclusion

The transition from product to platform represents a fundamental strategic shift that requires different metrics, organizational structures, and investment priorities. Companies successfully executing this transformation achieve revenue multipliers (such as Shopify's 4x increase in partner revenue) and accelerated growth rates (Stripe's 45% CAGR) that traditional product-focused approaches cannot match.

There will be more tools implementing AI-powered API management tools, deploying self-defending security capabilities, investing in API-as-a-Product approaches with enhanced developer portals, and building embedded compliance capabilities.

As the API economy matures, there will be increased consolidation among API providers. Organizations will have to choose between scale (competing with tech giants) or specialization (dominating vertical niches) as undifferentiated middle positions become unsustainable. New vibe-coded products will emerge, and Big Boys will utilize their strengths to bind and lock up clients while having access to their data.

Companies that fail to adapt to platform dynamics will face gradual marginalization, as API-first competitors capture market share through superior integration capabilities, faster innovation cycles, and more substantial network effects.

That's all I have for you today. Thank you for reading. If you haven't subscribed, I highly encourage you to do so - it's free. I would appreciate it if you shared it with just one person from your network. Thank you.

Valuable content deserves to be shared – post the link on LinkedIn, share it on Slack. Tell your friends. This word-of-mouth marketing is the most effective way to reach new readers.

I'm just getting started, but I guarantee you'll receive high quality in every future edition. High five!