Anthropic overtakes OpenAI in enterprise AI

The text below provides an in-depth analysis of how Anthropic overtook OpenAI's pole position. We see not only a change, but it's a comprehensive case study on building great AI products.

At the outset, I'd like to welcome new subscribers. And thank you all for your trust and for being here. I write for myself, BUT knowing how many people have been reading this is my greatest reward. Thank you for being here!

This is a weekly newsletter where you can find thoughtful analyses at the intersection of business and technology. I uncover underlying mechanisms and describe what truly drives our modern world, looking beyond surface-level trends. To receive Monkey by the Chess in your inbox, subscribe here for free:

When ChatGPT debuted in November 2022, I was in my MBA studies. I had the feeling that this was something big. Back then, the popular belief was that it's better to be first than to be the best. Today, it's no longer relevant.

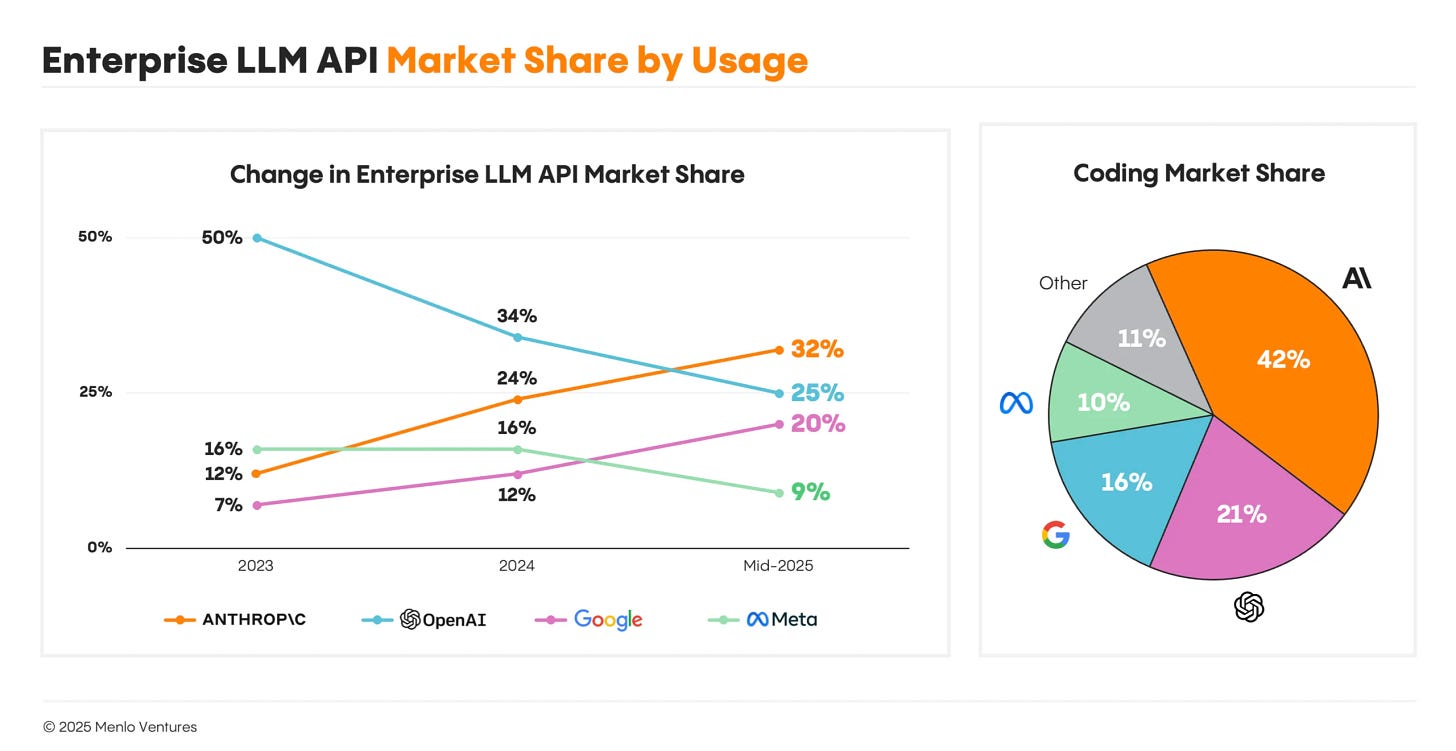

OpenAI, which controlled half of the enterprise AI market as recently as 2023, now holds merely 25% market share, while Anthropic, with its Claude models, has taken the lead with an impressive 32% of the market.

This isn't just a change of leadership, it's a case study showing how quickly a dominant position can collapse in an era of lightning-fast technological iterations and building products that serve people better.

Data from the latest Menlo Ventures 2025 Mid-Year LLM Market Update reveals the scale of this strategic shift. In just two years, OpenAI lost half of its market share in the most lucrative AI segment: enterprises.

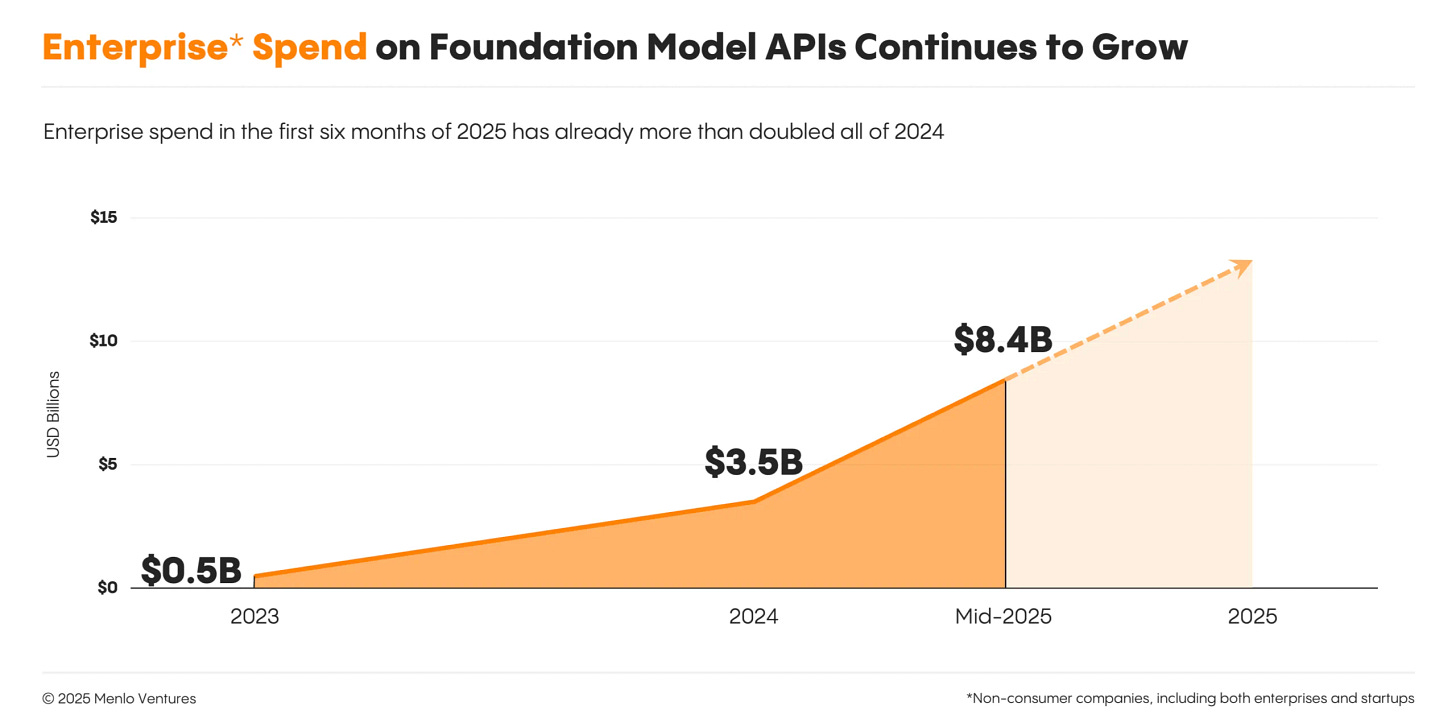

Simultaneously, enterprise spending on language model APIs exploded from $3.5 billion to $8.4 billion in just six months of the first half of 2025, with Anthropic capturing the majority of this growth.

This is no coincidence. The shift was the result of significant differences in business strategy, technological approach, and understanding of enterprise customer needs. The Anthropic passing offers lessons about the fragility of technological advantage in a world where speed means more, code can be rewritten in a week, and customer loyalty is as fragile as the performance of the latest model.

It's worth noting the work that Google has also done. Really rolling up their sleeves and delivering an increasingly better product.

To be the first

To understand the scale of OpenAI's downhill ride, we must trace the key moments that led to this slide. The turning point came on June 21, 2024, when Anthropic introduced Claude 3.5 Sonnet with the breakthrough Artifacts feature. For the first time since the GPT-4 release, the market received a model that not only matched but in many aspects surpassed OpenAI's flagship product. Benchmark data showed that Claude 3.5 Sonnet achieved 64% effectiveness in agentic coding tests, while GPT-4o managed only 38%.

Simultaneously, the new model was twice as fast as its predecessor and cost significantly less. $3 per million input tokens compared to OpenAI's much higher rates.

I believe that at the enterprise client level, utilizing AI in critical business processes offers a compelling incentive to switch to a more efficient, faster, and cost-effective alternative. The real breakthrough, however, came on February 24, 2025, with the release of Claude 3.7 Sonnet, the first hybrid reasoning model on the market.

The introduction of two working modes: instant and "extended thinking," with a budget of up to 128,000 tokens, has revolutionized autonomous coding capabilities. The simultaneous release of Claude Code as a command-line interface (CLI) tool for developers directly challenges OpenAI's ecosystem.

OpenAI tried to respond on February 27, 2025, with the release of GPT-4.5, but the model turned out to be... a failure. Operating costs at the level of $75-150 per million tokens while competing with Claude offering similar capabilities for a fraction (3$ per million tokens) of the price forced the company to withdraw the model from the API on April 14, 2025.

And then on 22.05.2025, Anthropic introduced Claude 4 to the family.

Claude Opus 4 achieved 72.5% on SWE-bench, setting a new industry record, while OpenAI's GPT-4.1 achieved only 54.6%. Moreover, the new models demonstrated the ability to conduct seven-hour autonomous coding sessions without losing focus or context.

Musings over the numbers

When we examine the market statistics, numbers tell us a story with key lessons under the hood.

In the code generation segment, Claude captured 42% market share, more than doubling OpenAI's 21%. This is a particularly painful loss/ difference, considering that coding was one of the first mass applications of GPT and the foundation of GitHub Copilot's success.

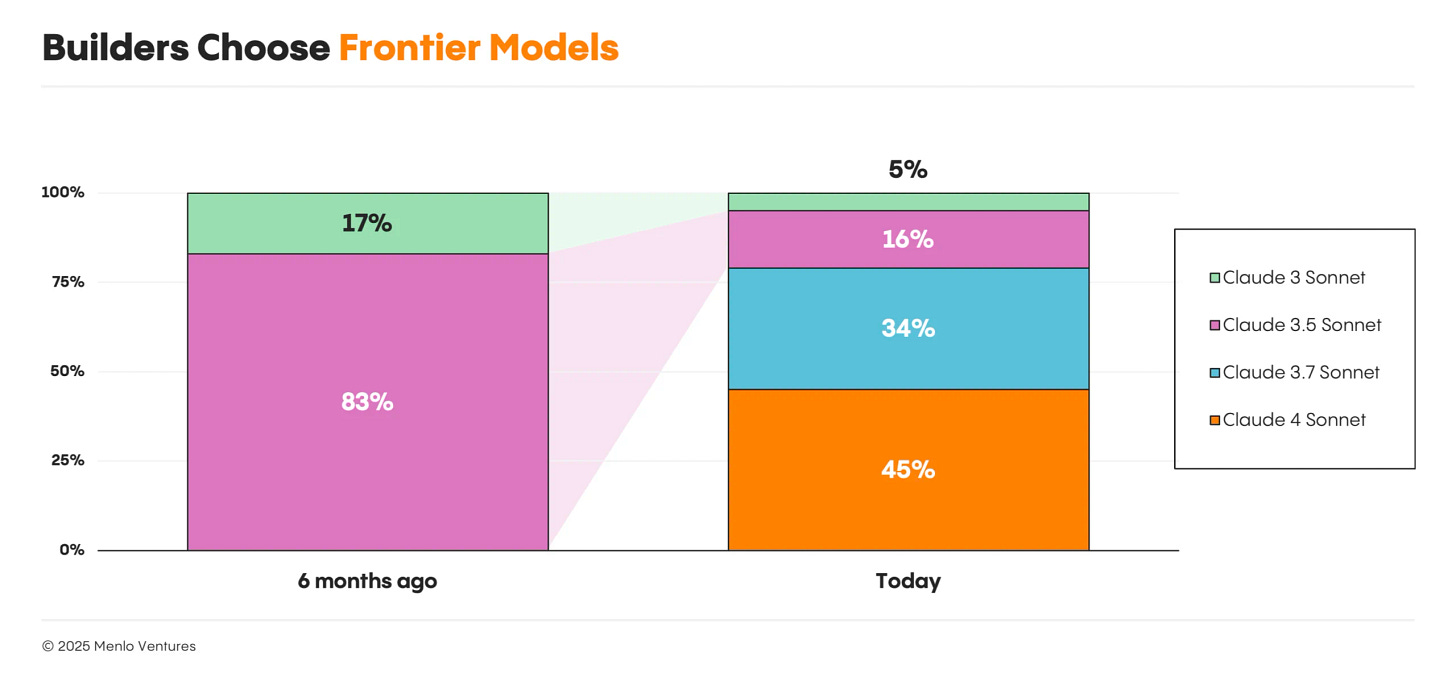

Even more revealing is the so-called "lightning adoption model" demonstrated by Anthropic users. Within just one month of Claude 4's release, a full 45% of users migrated to the new model, simultaneously abandoning Claude Sonnet 3.5, whose share dropped dramatically from 83% to 16%. This migration speed was unprecedented in enterprise software history, demonstrating how much enterprises prioritize performance over convenience or brand loyalty.

User base, monetization, and financial challenges.

If we additionally take a look at the user base, there are also a couple of interesting things to outline. Despite having a 42 times larger user base than Anthropic (800 million weekly vs. 18.9 million monthly), the company generates only 2.5 times higher revenue ($10 billion vs. $4 billion ARR). This means that Anthropic achieves 8 times higher monetization per user: $211 monthly compared to $25 at OpenAI.

Focus on the client’s needs & fears.

Anthropic's success is a case study of enterprise-first strategy in practice. While OpenAI focused on viral consumer growth and tried to monetize ChatGPT's user base, Anthropic designed its products from the beginning with enterprise needs in mind.

One key factor in achieving success with enterprises was addressing the fear of AI regulations and potential compliance issues. Anthropic approach was to offer a built-in safety mechanism and ethical guardrail, which became a critical selling point. Constitutional AI is not just a technological curiosity but a strategic competitive advantage.

Claude's dual-mode system, offering both instant responses and extended thinking sessions, was an answer to real enterprise workflow needs. Technical analysis reveals that Claude's success wasn't accidental but resulted from a fundamentally different approach to model architecture.

Better product

Architectural differences between models are also fundamental. Claude 4 offers a 500,000 tokens context window in the enterprise version, while GPT-4 limits itself to 32,000. For companies analyzing complete codebases, hundreds of documents, or long sales transcripts, this difference means a chasm in practical usability.

Reinforcement Learning with Verifiers (RLVR): Anthropic's key innovation from 2024 enabled breaking through performance plateaus that affected OpenAI models. While OpenAI relied mainly on scaling pre-training, which became increasingly expensive and less effective, Anthropic developed post-training techniques that were more cost-effective and targeted.

Model Context Protocol (MCP) is another example of enterprise-first thinking. Instead of a closed ecosystem API, Anthropic created an open standard enabling native integration with thousands of enterprise tools. For companies, MCP meant seamless workflow integration, impossible with traditional APIs.

Partnerships

Anthropic's partnership strategy also proved more valuable and more thoughtful. Amazon's $8 billion investment and Google's $2 billion provided not only capital but, most importantly, multi-cloud distribution. Unlike OpenAI, which became dependent on its Microsoft partnership, Anthropic maintained strategic independence, able to offer its models through AWS, Google Cloud, and other enterprise platforms.

Value Proposition

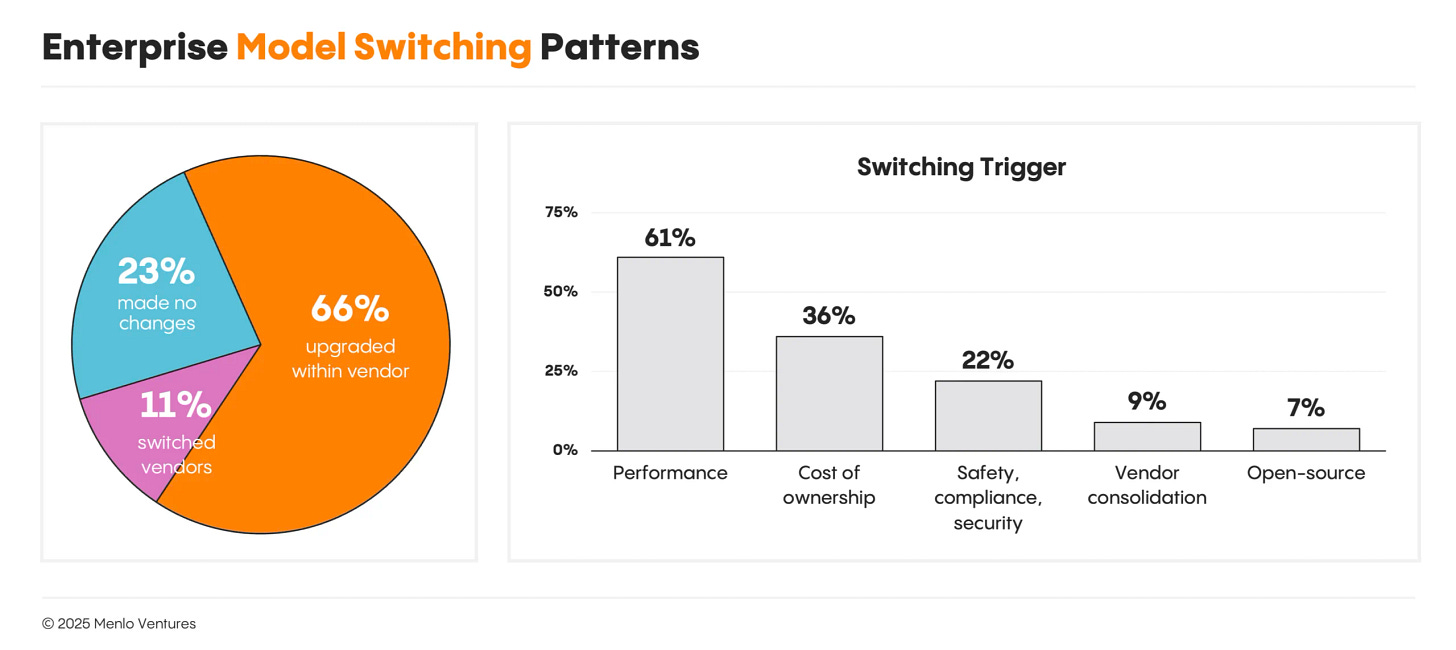

The Menlo Ventures study reveals that only 11% of organizations change AI providers within a year, meaning migration from OpenAI to Anthropic required exceptionally compelling arguments. Key decision factors are security and data protection (46%), price (44%), performance (42%), and extended capabilities (41%).

In each of these areas, Anthropic offered a better value proposition.

Claude doesn't train on enterprise customer data without explicit opt-in, while OpenAI requires explicit opt-out. Compliance features like SOC 2 Type 2, HIPAA compliance, SSO, SCIM support, and granular audit logs were available from day one, not as premium add-ons.

Migration cycles

"Within one month of Claude 4 release, for instance, Claude 4 Sonnet captured 45% of Anthropic users while Sonnet 3.5 share decreased from 83% to 16%."

In traditional enterprise software, migration cycles are measured in quarters or years. In AI, they are measured in weeks.

Transitioning to Claude 4 deserves special attention as a case study of enterprise decision making.

Switching costs are near zero; changing from one API to another is often a matter of a couple of hours and a few lines of code. In parallel, the benefits are immediately measurable differences in accuracy, speed, or capabilities that are obvious within the first week of use.

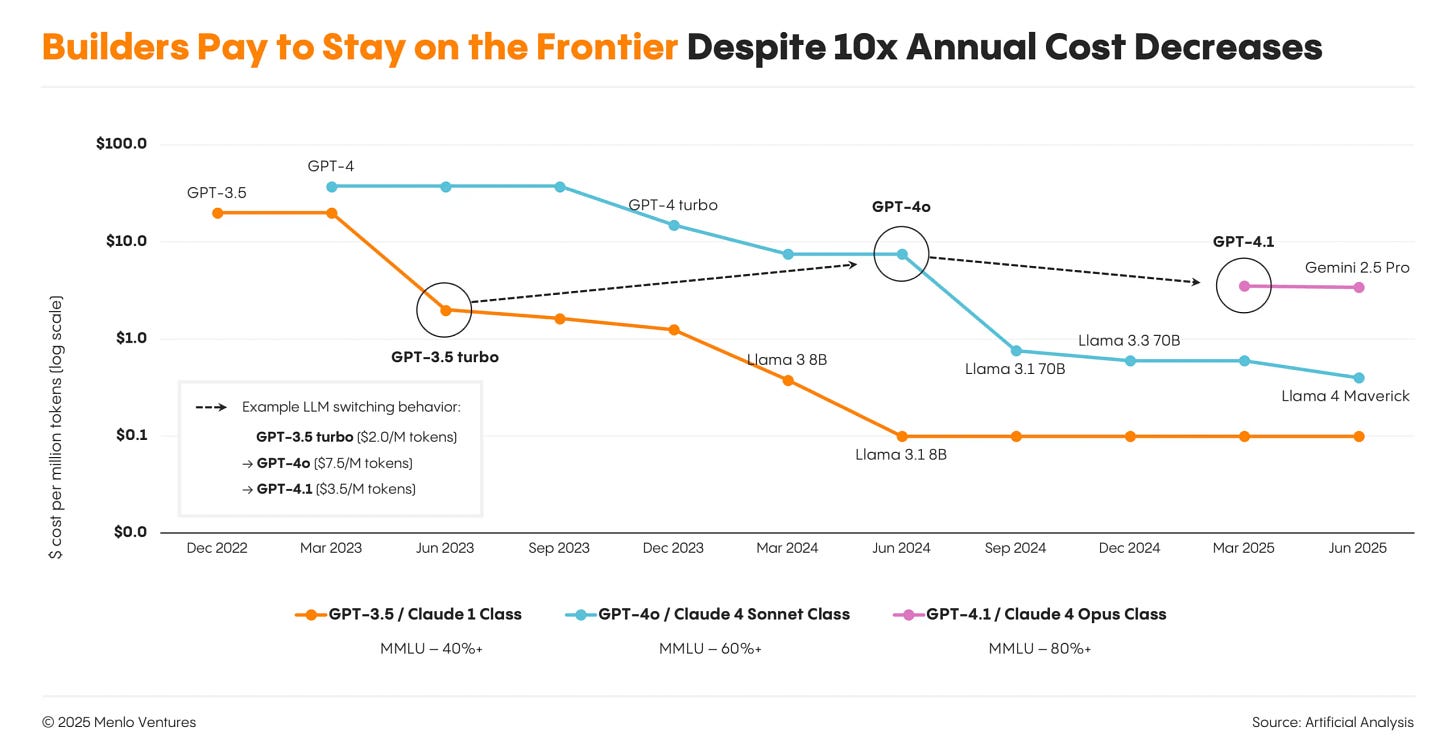

Enterprise customers quickly learned that "performance is king". Despite 10x price drops for older models, organizations systematically choose the newest, most efficient options. It seems that brand loyalty or sunk costs are irrelevant in the face of competitive advantage flowing from superior AI capabilities.

ChatGPT remains the most recognizable AI brand in the world, but in B2B markets, where technical leaders make decisions, brand awareness proves secondary to measurable performance.

Business model

The quality of monetization can be more important than being first and the scale of users. Anthropic's enterprise-first approach proved to be more powerful, and focusing on high-value enterprise customers generates not only higher unit economics but also more predictable revenue streams and greater customer lifetime value than OpenAI's consumer-first viral growth.

Winner-takes-most

Enterprise AI spending reached $8.4 billion in the first half of 2025, while total venture capital in AI startups constituted 57.9% of all global VC funding in Q1 2025.

For me, the moves of Big Tech are particularly interesting. Microsoft, OpenAI's biggest ally, has an exclusive partnership that was supposed to be a competitive advantage. In May 2025, Copilot had been integrated with Claude models. Amazon invested $8 billion in Anthropic. Google invested $2 billion in Anthropic, despite developing its own Gemini models. All shows a hedge betting strategy when the AI market may be winner-takes-most, but not winner-takes-all, as previously assumed.

“I have an uncompromising sense of detail which permeates everything I do. The meals I serve, the parties I have, the business I created, the places I go, my friends, my family, my business associates, everything must be treated with infinite respect and care.” Estée Lauder

Fragility of technological advantage

First-mover advantage, which seemed insurmountable in 2023, was neutralized within 18 months.

And it looks like technology moats are increasingly ephemeral, and focusing on clients, product, and business model can be more durable. Anthropic's focus on safety, compliance, and enterprise needs creates unique opportunities and positioning that is harder to copy than pure technical capabilities.

I see this change of pole position as a lesson about strategic misalignment between company priorities and market needs. While OpenAI pursued consumer scale and viral growth, Anthropic systematically built the capabilities and partnerships needed for enterprise success.

My key takeaway is that in the era of rapid innovation, when speed is crucial, sustainable competitive advantage comes more from the business model, and pure technological superiority that fits clients' needs should also be in place. Of course, technology might be copied, partnerships won't last forever, but a deep understanding of customer needs and laser focus on a specific segment creates more durable value.

In a world where AI capabilities are increasingly commoditized, companies that understand this dynamic will be better positioned for long-term success. Monthly product cycles are the norm, and strategic agility may be the most important capability of all.

This story serves as a cautionary tale: even the most dominant market position can be vulnerable if a company doesn't adapt its strategy to evolving customer needs and competitive landscape.

That's all that I've for you today. Thank you for taking the time to read this newsletter.

If you enjoyed this text and found value in it, please subscribe to my newsletter.

Valuable content deserves to be shared – post the link on LinkedIn, share it on Slack. Tell your friends. This word-of-mouth marketing is the most effective way to reach new readers. I'm just getting started, but I guarantee you'll receive this quality in every future edition.